Author: Mariel Vincent Rapisura

-

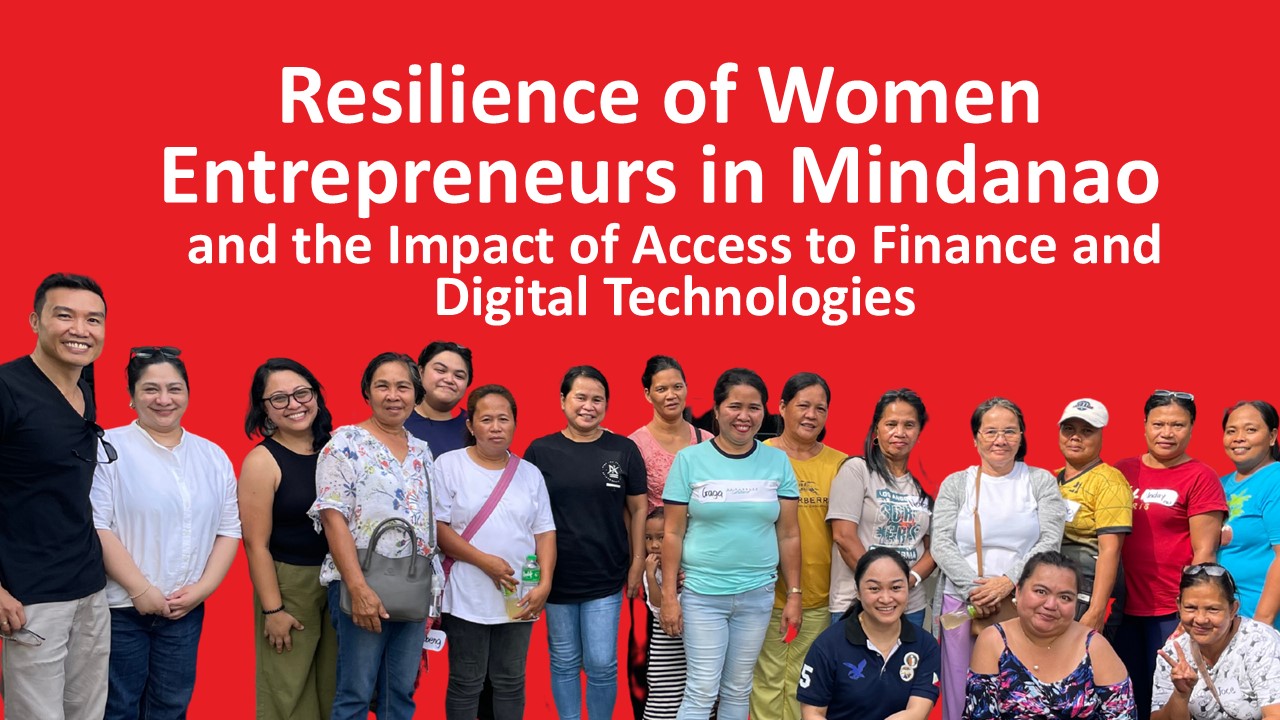

Resilience of Women Entrepreneurs in Mindanao and the Impact of Access to Finance and Digital Technologies – Presentation Transcript

The following is the transcript of the paper presentation delivered by Vince Rapisura, President of the Social Enterprise Development Partnerships, Inc. (SEDPI) and Lecturer at Ateneo de Manila University, during the forum “Women Entrepreneurship and Financial Inclusion.” The event was held at the Ateneo de Manila University on March 20, 2025, and co-organized by the…

-

Delinquency Management

Ateneo de Manila-SEDPI NanoEnterprise Development Program(formerly the Ateneo Microfinance Capacity-Building Program) Course Objectives: Course Description: This course equips microfinance practitioners with essential tools and strategies to manage loan delinquency effectively. Participants will explore causes, costs, and borrower perspectives on repayment, learn key metrics like portfolio at risk, and apply loan classification and collection techniques. Gain actionable…

-

Islamic Finance 101: Principles and Practices for Microfinance Practitioners

Ateneo de Manila-SEDPI NanoEnterprise Development Program(formerly the Ateneo Microfinance Capacity-Building Program) Course Objectives: Course Description: Discover the foundations of Islamic finance and its applications in microfinance. This course covers Shari’ah-compliant principles, ethical finance practices, and practical tools for empowering communities. Gain insights into profit-sharing, risk-sharing, and asset-backed arrangements that prioritize fairness and community well-being, tailored for…

-

Vince Rapisura Advocates for Financial Wellness Among Doctors and Democratization of Beauty at Dermatology Event

At the recent True North: Mapping the Future of Dermatology event organized by the Philippine Dermatological Society in Baguio City, financial literacy expert Vince Rapisura delivered a compelling talk addressing the unique financial challenges faced by doctors and proposing innovative solutions to democratize beauty in the Philippines. Rapisura began by outlining the financial profile of…

-

Nanoenterprises Confront Inflation: A Mixed Recovery Landscape in Early 2023 Update 19 of SEDPI’s Rapid Community Assessment (RCA) January – March 2023

In the first few months of 2023, nanoenterprises continue their journey towards recovery, now facing the added challenge of rising prices. Our latest study at Social Enterprise Development Partnerships, Inc. (SEDPI) provides new insights into how nanoenterprises are doing. Although there are signs of improvement, the issue of inflation is making the recovery process harder…