Category: Financial Literacy

-

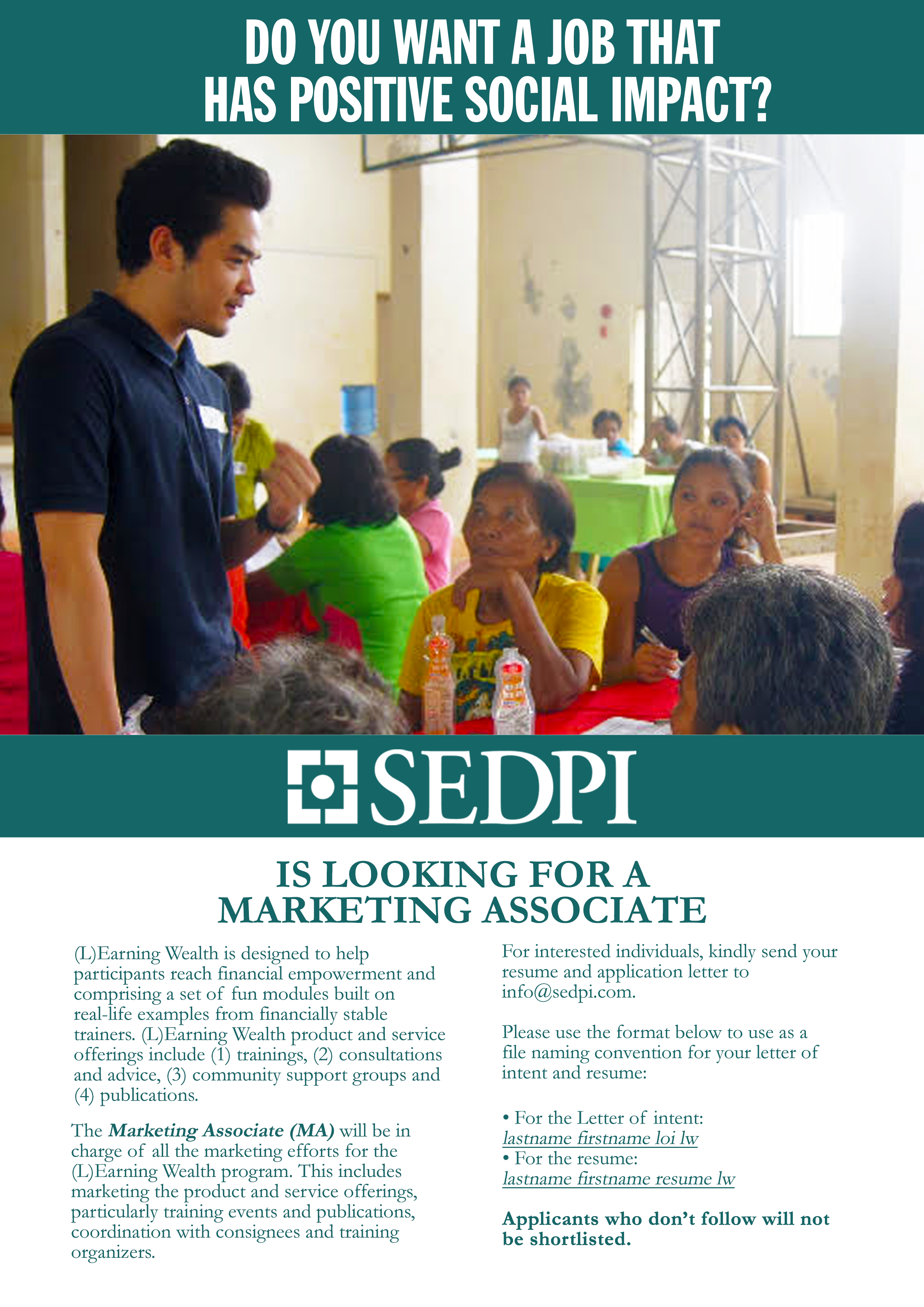

Job Opening | Marketing Associate

Do you want a job that has positive social impact? Are you interested in promoting financial literacy? (L)Earning Wealth is currently looking for a Marketing Associate. (L)Earning Wealth is SEDPI’s flagship program for financial literacy. SEDPI is the premiere capacity building institution providing training, research and consulting services in the areas of microfinance, social entrepreneurship and…

-

Importance and Characteristics of a Rainy Day Fund

By: Romeo Arahan Jr. One of the pre-requisites in pursuing financial freedom is to have a rainy-day fund, or an emergency savings fund. What it does is it provides an individual, access to funds in an extremely urgent and critical event. SEDPI advises its participants to follow the three rules in forming their rainy day…

-

Why Financial Literacy is Crucial to Microfinance Staff

by Denise Subido Microfinance Institutions (MFIs) face a myriad of issues in running their day-to-day operations. One problem they are constantly faced with is delinquency. Delinquency is a prevaling problem that has negative repercussions for an institution. One peculiar finding, however, is that when there is delinquency, there are also cases of fraud. In fact,…

-

Financial Literacy for CASS Beneficiaries

by Carlo Niño Yacob The Climate Adaptation Support Services (CASS) project intends to develop communities in Siargao Island, Surigao del Norte, toward climate-resiliency through economic empowerment. Climate Change Commission (CCC) in collaboration with Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) implements CASS. With financial support in the form of cash transfers coming from the government, it…

-

Traditional Investing Versus Socially Responsible Investing

By: Gio Naidas and Mariel Vincent Rapisura Investing is the act of purchasing a financial product, asset, or other item of value with an expectation of favorable future returns. Investments provide the benefit of generating passive income which helps us attain our financial goals, afford higher standards of living and at the very least beat…

-

Pulilan LGU Adopts Mobile Money

by Denise Subido Today’s world is made smaller and more convenient through the use of technology. What was once impossible or inconvenient can now be done with one touch on your mobile phone. In the Philippines, 80% of households have at least one mobile phone. Aside from making calls, texts and use of internet, mobile…

-

Five Emotions That Prevent Financial Success

by Ann Carl Bailey People often believe that financial management is all about money and has nothing to do with emotions. Wrong! Learning to manage your emotions actually helps in making rational financial decisions that works to your advantage. Mariel Vincent Rapisura, president and chief executive officer of SEDPI, speaking to employees of the Department…

-

331 OFWs Graduate from ADMU LSE in 2015

by Reichelle Carlos “LSE has been a wake-up call for me to put my finances in order and gave me a roadmap for my financial goals.” This year, 331 more of our modern-day Filipino heroes all over the world are better equipped with skills on dealing with their finances and economic situations. They are the…

-

Yolanda and the Filipino Resiliency

By: Emilenn Sacdalan-Pateño The Philippines is known as one of the most hazard-prone countries in the world. In a 2008 World Bank study, the country was identified as a natural disaster hot-spot with approximately 50.3% of its total area and 81% of its population vulnerable to natural disasters. The United Nations University Institute of…