Category: Microenterprise

-

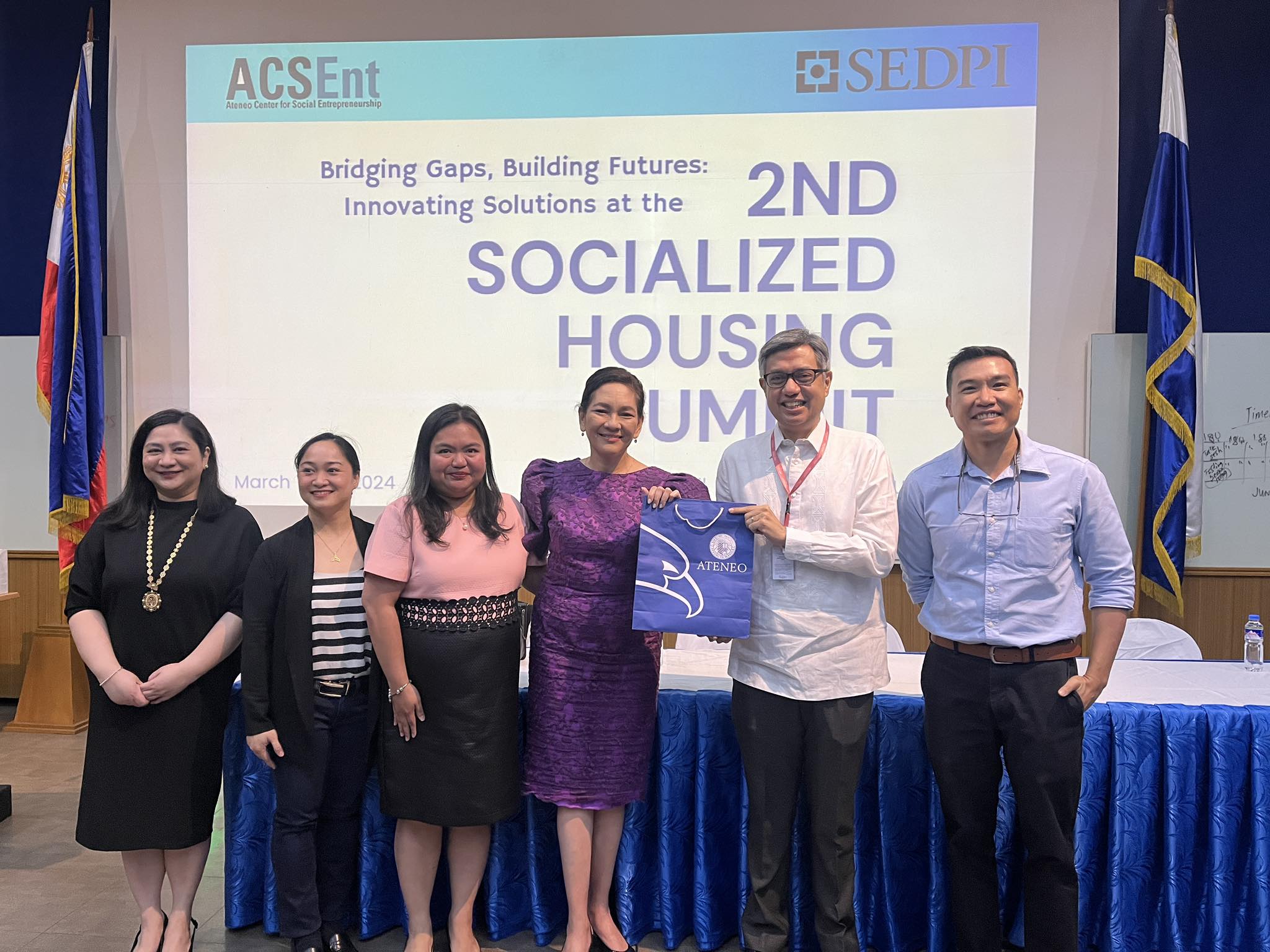

Citihub Founder Panya Boonsirithum Advocates for Affordable Urban Housing at the 2nd Socialized Housing Summit

In a striking presentation at the 2nd Socialized Housing Summit, held on March 18-19, 2024, at the Ateneo de Manila University, Panya Boonsirithum, the founder of Citihub, shared his visionary approach to addressing Metro Manila’s housing crisis. Organized by the Ateneo Center for Social Entrepreneurship (ACSent) and Social Enterprise Development Partnerships Inc. (SEDPI), the summit…

-

Socialized Housing Production Hits Record Low,SHDA Highlights Compliance Challenges at Housing Summit

During the enlightening 2nd Socialized Housing Summit, Santiago F. Ducay from the Subdivision and Housing Developers Association (SHDA) presented a concerning update on the state of socialized housing in the Philippines. The year 2023 saw the production of socialized housing units plummet to a historic low since 2001, with only 10,113 units completed. This stark…

-

DENR’s Engr. Romeo P. Verzosa Outlines Land Titling Reform at the 2nd Socialized Housing Summit

The second day of the 2nd Socialized Housing Summit, co-organized by the Ateneo Center for Social Entrepreneurship (ACSent) and Social Enterprise Development Partnerships Inc. (SEDPI) on March 18-19, 2024, at Ateneo de Manila University, featured Engr. Romeo P. Verzosa, Assistant Director of the DENR – Land Management Bureau. His presentation provided an essential overview of…

-

SHFC Aims to Transform Lives with Resilient Communities Amid Housing Challenges

At the 2nd Socialized Housing Summit held at Ateneo de Manila University, Atty. Junefe G. Payot from the Social Housing Finance Corporation (SHFC) presented an approach to combat the Philippines’ housing backlog through resilient community-driven projects. Amidst a critical period where the production of socialized housing units plummeted to an all-time low in 2023, SHFC’s…

-

Senator Risa Hontiveros Advocates for Innovative Social Housing Solutions at the 2nd Socialized Housing Summit

Manila, Philippines – At the 2nd Socialized Housing Summit held at Ateneo de Manila University, Senator Risa Hontiveros delivered a compelling speech, outlining the dire need for innovative and inclusive solutions to the Philippines’ housing crisis. Addressing a gathering of developers, microfinance institutions, academes and housing advocates, Senator Hontiveros emphasized the dream of every Filipino…

-

Empowering the Marginalized: SEDPI’s Innovative Path in Nanoenterprise Development

Empowering the Marginalized: SEDPI’s Innovative Path in Nanoenterprise DevelopmentVince RapisuraJanuary 11, 2024 Established in 2004, the SEDPI Group of Social Enterprises focuses on empowering marginalized Filipino communities via sustainable nanoenterprise growth. Their multifaceted approach includes nanofinancing, social investments, and financial education, addressing poverty and promoting financial stability. Despite advances in microfinance, poverty and high indebtedness…

-

Symbiotic Synergies: Crafting a Future of Empowered Health with SEDPI and ASMPH

Esteemed Deans and respected colleagues, I am Vince Rapisura, 20 years with Ateneo, and proudly co-founding the Social Enterprise Development Partnerships, Inc. or SEDPI in 2004 with Edwin Salonga. I stand before you to propose strategic partnership with the Ateneo School of Public Health and Medicine. Our group, spanning 8 organizations, envisions empowered Filipinos globally,…

-

The Rice Price Cap in the Philippines: Pros, Cons, and Long-Term Implications

In the wake of soaring rice prices, the Philippines has found itself in the midst of a contentious debate over the imposition of a rice price ceiling. As the staple food of the nation, rice plays an integral role in the daily lives of millions, making its affordability and accessibility crucial. President Bongbong Marcos, wearing…

-

SEDPI at 19: Pioneering change and empowering communities

Warm greetings to you all. It fills me with immense joy and gratitude to stand before you on this significant occasion – the 19th anniversary of the SEDPI Group and the inauguration of our new headquarters in Rosario, Agusan del Sur. It’s wonderful to see so many familiar faces and new ones alike, as we come…

-

Comparative Overview of Nanoenterprises, Microenterprises, and Gig Economy Jobs: Characteristics, Market Factors, Risk Resilience, and Potential Impact

Introduction Across the economic landscape of the developing world, one cannot overlook the proliferation of small scale enterprises that create a significant economic impact at the grassroots level. This intricate tapestry of economic activity, composed of nanoenterprises, microenterprises, and gig economy jobs, holds tremendous potential for poverty alleviation and socio-economic mobility. To unlock this potential,…