SEDPI is a group of social enterprises that provide capacity building and social investments to development organizations and directly to microenterprises. We serve ~8,000 microenterprises in Agusan del Sur and Surigao del Sur, two of the poorest provinces in the Philippines.

Most of our members, about nine in 10, are women with an average age of 42. These women are typically into vending, farming, fishing, dress making, selling food, and livestock backyard raising.

Community assessments

Every week, since the community quarantine was imposed on March 15, 2020; SEDPI conducted community assessment research with its members. These were conducted on March 15, March 30, April 5 and April 14; through rapid survey via text messaging and calls with our members.

The rapid community assessment aims to determine the economic impact of COVID-19 on our members and to have a clearer picture of what transpires on the ground. We asked our members the following:

- Status of their livelihood – unaffected, weakened or stopped

- Experience symptoms of COVID-19

- Access to government assistance

- Support needed after the community quarantine

Impact of COVID-19 to microenterprises and informal sector

All microenterprises were negatively affected due to COVID-19. Immediately after the community quarantines were announced, 34% of microenterprises stopped their livelihood. After two weeks this spiked to 51% and slightly recovered to 41% after a month of lockdown.

Some microenterprises reopened their livelihood because they need to earn income to have enough budget to buy rice at the minimum. They sourced locally-available inputs to do this and were able to sell banana cue, camote cue, cassava cake and rice cakes among others.

Majority of microenterprises or 59% reported that their livelihood weakened. Of which, 59% and 31% reported significant and severe weakening of livelihoods resepectively.

Supply chain disruption; inability to deliver goods and services; and prohibition to open non-essential businesses were the main reasons given for stopping or weakning of their livelihoods. With families having to stay home and most business remain closed, there are very few buyers of their products and services. Most barangays prohibit entry of non-residents which prevent others from going to work.

Exposure to COVID-19

An encouraging finding in the rapid community assessment is that only 2 of the 6,071 respondents are persons under monitoring. This may be a positive sign that the community quarantine is effective in containing the rapid spread of the virus.

The quarantine period was extended to April 30 and the question now is how much longer can the poor endure its negative effects to their livelihoods. Many of them are saying that they might die first of hunger before getting infected with COVID-19.

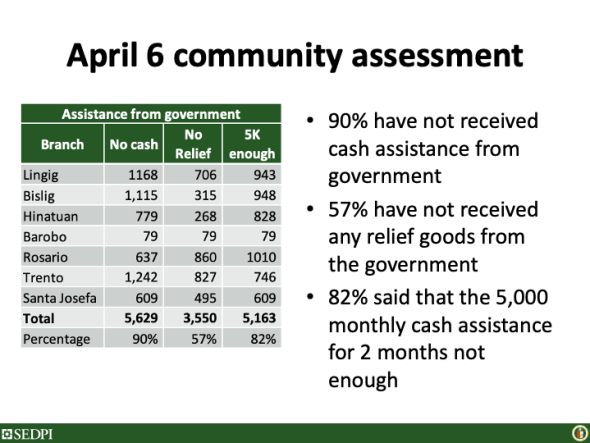

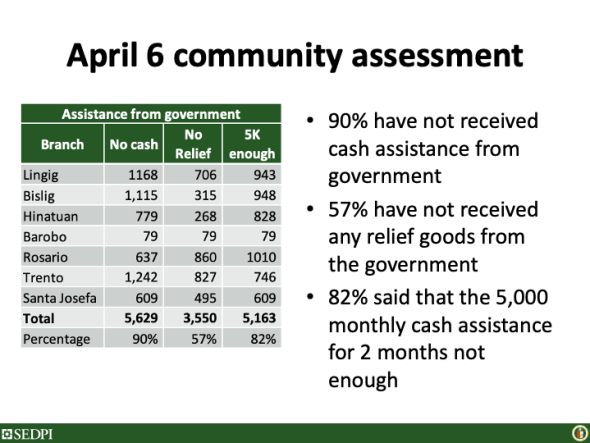

Access to government assistance

It is important to consider the well-being of low-income groups and provide them with enough economic support and social safety nets during this quarantine period. The government’s cash assistance and emergency relief is very much needed on the ground to help them survive.

Only one of ten microenterprises or 11% were able to receive cash assistance; and 60% received relief goods from the government as of April 14. This is an improvement of 1% and 17% respectively from the previous week showing marginal improvement in access to government assistance.

Those who received cash assistance got PhP3,000 to PhP4,000. Most of them received PhP3,600 cash assistance through the 4Ps program of the Department of Social Welfare and Development.

Relief goods received were composed of rice, canned goods and soap. Most of those who received these said that the supply will only last them for 1-2 days. Most of the respondents or 82% also expressed that the PhP5,000 cash assistance will not be enough to cover their daily needs in the next two months.

Recommendations during community quarantine

Hasten government cash assistance and relief

The government needs to hasten release of cash assistance and relief goods to microenterprises and the informal sector. These will alleviate their burden and enable them to survive the community quarantine.

Prohibit interest accrual on MSEs loans

Interest accrual for loan of micro and small enterprises during the quarantine period should be prohibited. On April 3, Ateneo-SEDPI Microfinance Capacity Building program released a position paper regarding this.

The continued charging of interest during community quarantine is socially unjust since this gives additional burden to microenterprise and small enterprises at a time when they can barely survive. This is an unnecessary additional expenses that will make their lives even harder during the rebuilding and recovery phase.

Mass testing

Prioritize mass testing to suspect and probable COVID-19 individuals who belong to low income groups, especially in urban centers, where spaces are cramped and transmission could happen faster.

Free testing services should be provided to make sure that transmission in low-income groups is prevented and managed properly. Local government units should have isolation areas for PUIs and PUMs to prevent the spread of the disease in rural and urban poor communities.

Recommendations immediately after community quarantine

The rapid community assessment showed that 77% of respondents request for cash assistance to restart their livelihood after the community quarantine. Many of the members or 35% would still need relief goods, especially food, immediately after the quarantine and A few or 12% need work to have source of income.

The rapid community assessment showed that 77% of respondents request for cash assistance to restart their livelihood after the community quarantine. Many of the members or 35% would still need relief goods, especially food, immediately after the quarantine and A few or 12% need work to have source of income.

Cash assistance to restart livelihoods through MFIs

Request for cash assistance to restart livelihoods should be coursed through microfinance institutions (MFIs) to eliminate dole-out mentality. The cash assistance should be given, at the minimum, as 0% loans to microenterprises and the informal sector.

MFIs are well positioned to provide this intervention since they would need to support the rebooting of the livelihoods of their client base. The cash assistance will be collected alongside restructuring of existing loans of clients so that financial service delivery will continue.

Bail out MFIs

MFIs access funds from commercial banks and government financial institutions that they extend as microcredit to low income groups. Based on the Consultative Group to Assist the Poor’s (CGAP) estimate, an 85% repayment rate in MFIs would only have sufficient cshflow to last in the ext six months.

The impact of the pandemic will surely negatively impact repayment rates of MFIs. Based on the figures of those negatively affected, SEDPI estimates that it repayment rates in the next three months after the quarantine period may hit as low as 20% to 30%. Due to this, most MFIs will experience liquidity problems.

Government should intervene and infuse capital in the form of equity to MFIs to fund the proposed cash assistance intended to restart microenterprise livelihoods. Another way of doing this is to temporarily convert debt obligations of MFIs from commercial banks and especially from government financial institutions to equity to ease pressure in debt repayments.

MFIs will eventually pay this equity back to the government, perhaps event at a premium, once they recover from the crisis. SEDPI strongly suggests moving away from debt-based development assistance since interest will ultimately be passed on as additional burden to microenterprises and the informal sector.

This strategy is similar to the bailout of governments to large financial institutions during the 2008 financial crisis. If governments are willing to bail out large corporations, they should also be willing to do the same to MFIs that directly help those at the bottom of the pyramid.

Pay for work programs

Development organizations and government should provide pay-for-work programs to spur local economic development. This will create temporary employment and give purchasing power that will augment efforts to restart of livelihoods.

0% SSS and Pag-IBIG calamity loans

Microenterprises and informal sector who are members of SSS and Pag-IBIG could benefit from the calamity loans offered. Per published policy of these two organizations, members are allowed to borrow calamity loans against their personal contributions.

The interest rate for calamity loan is 5.95% for Pag-IBIG and 10% for SSS. It is highly recommended to bring the interest on the calamity loans to 0%, since these are drawn from personal contributions of members anyway.

Recommendations for the long term

Ease in access to identity documents

Access to government basic services starts with identity. The Philippine Statistics Authority should streamline processes for low-income groups to get government identification documents such as birth certificates, marriage certificates, and licenses.

Greater financial inclusion

It is also important to focus more on financial inclusion to make sure that bank accounts are opened for all low-income families so that they can easily access cash transfers and cash relief in times of disaster. This will ensure that funds truly land in the pockets of low-income groups, and could potentially reduce corruption and patronage politics.

Universal disaster insurance

It is also high time to have universal disaster insurance since the Philippines ranks high in the World Risk Index. This will make us better prepared for disasters and pandemics in the future.

The scheme will provide funds to affected communities, especially low income groups, to cope with the disaster and to rebuild livelihoods. Having disaster insurance will eliminate the need for low income groups to beg for government assistance from politicians.

Tap vast network of MFIs

Microfinance institutions are rooted well in communities and have vast networks that penetrate even the most remote areas. This makes them suitable for information dissemination as well as for distribution of government assistance.

Prioritize support and assistance to the bottom of the pyramid

We may be already enjoying the positive effect of the commuity quarantine to prevent the sudden spread of COVID-19. However, its negative economic impact especially to vulnerable sectors such as microenterprises and the informal sector, is undeniable.

To sustain and complement the gains of the quarantine, priority and free mass testing to low income groups is needed. This will hopefully flatten and at the same time shorten the curve.

Government should hasten delivery of cash and relief assistance to low income groups to alleviate the burden of low income groups. MFIs could complement barangay level legwork for information dissemination and distribution of government assistance with its vast network and penetration in rural areas.

To ease the economic burden of low income groups, the government should stay true to the intent and spirit of the Bayanihan Act, that prohibit accrual of interest and other fees during the quarantine period.

Immediately after the quarantine period, to help jumpstart the economy, the government could provide pay for work programs; and provide cash assistance to microenterprises through MFIs. It could bailout MFIs to ensure continued delivery of much needed microfinance services to the poor.

The proposed 0% calamity loans of Pag-IBIG and SSS could provide much needed relief to microenterprises and the informal sector. In the longer term, structural challenges could be addressed through providing ease in access to identity documents, broader financial inclusion, and universal disaster insurance.

When we channel resources to help microenterprises and the informal sector, we make our nation better poised to recover faster from the negative effects of COVID-19.

Two months after the government started easing lockdowns in most parts of the country, 36% of nanoenterprises reported to have bounced back to pre-pandemic level. In May, only 18% expected to bounce back within one month which may be a good sign of recovery if the spread of the virus is contained.

Two months after the government started easing lockdowns in most parts of the country, 36% of nanoenterprises reported to have bounced back to pre-pandemic level. In May, only 18% expected to bounce back within one month which may be a good sign of recovery if the spread of the virus is contained.

With microenterprises cautious on demand, they prefer not to access loans. Only two of three of those who finished their loans opted to renew their for another cycle. This is also a sign that nanoenterprise have the ability to weigh risks and returns.

With microenterprises cautious on demand, they prefer not to access loans. Only two of three of those who finished their loans opted to renew their for another cycle. This is also a sign that nanoenterprise have the ability to weigh risks and returns. There are approximately 8 million low income households that access microfinance services in the Philippines. MFIs are frontliners in the delivery of financial services to low income groups who find it difficult to open deposit accounts and access loans from commercial banks.

There are approximately 8 million low income households that access microfinance services in the Philippines. MFIs are frontliners in the delivery of financial services to low income groups who find it difficult to open deposit accounts and access loans from commercial banks.

The rapid community assessment showed that 77% of respondents request for cash assistance to restart their livelihood after the community quarantine. Many of the members or 35% would still need relief goods, especially food, immediately after the quarantine and A few or 12% need work to have source of income.

The rapid community assessment showed that 77% of respondents request for cash assistance to restart their livelihood after the community quarantine. Many of the members or 35% would still need relief goods, especially food, immediately after the quarantine and A few or 12% need work to have source of income.

The COVID-19 pandemic continues to pose serious threats to health and has already disrupted the economy. This prompted the government to enact Republic Act No. 11469 otherwise known as the “Bayanihan to Heal As One Act,” declaring a state of national emergency in order respond to the urgent needs of the people.

The COVID-19 pandemic continues to pose serious threats to health and has already disrupted the economy. This prompted the government to enact Republic Act No. 11469 otherwise known as the “Bayanihan to Heal As One Act,” declaring a state of national emergency in order respond to the urgent needs of the people.